2024 HR Tech Predictions

Every year, I sit down before Christmas and write predictions about the HR Tech space. I am usually wrong, but it is still fun and helps me order my thoughts.

So, here are Alexander Chukovski’s 2024 HR Tech Predictions:

Consolidations in the programmatic space

When you look at the programmatic job advertising space, it is already a mature market.

We have two prominent players with a unified value proposition – end-to-end recruitment marketing. We have another prominent player still riding the AI wave as a core differentiation tactic and one more focusing on job boards.

These are the big 4 of programmatic job advertising.

Then we have a few smaller players that have either developed some local expertise or built a small customer base, but they don’t have any unique value proposition compared to the big-4. There are few objective reasons for these companies to exist outside the big-4.

Therefore, the market is ready for some consolidation or shakeup.

Either the top two players will try to acquire local experts to gain a competitive advantage in a country, or they will try to push prices down to grab customers from the small players without a unique value proposition.

Either way, by the end of 2024, we will have an acquisition, and some companies will stop operating.

Programmatic job advertising won’t grow much in DACH in 2024

DACH, short for Germany, Austria, and Switzerland, is the magic area where people can sell job postings for €1500.

Somehow, programmatic never made it large in DACH, and there are some pretty good reasons for that:

- Recruiters and hiring managers are used to job posting products.

- Recruitment marketing in DACH is five years behind current US trends.

- Robust agency market pushing job postings to clients due to good margins.

- Explaining programmatic to non-tech customers in SMBs is very hard.

- Market leaders are strategically positioned to stop advances in programmatic job advertising products and sales efforts (yes, Stepstone still owns Appcast).

- DACH has insufficient advertising channels to buy traffic on a CPC/CPA basis.

The last one is the most critical part: if you cannot advertise jobs beyond the usual giant international aggregators, how are you supposed to sell programmatic?

Some of you will scream: SOCIAL! True, social media as a channel works up to a particular scale and job categories, but it is a channel that gets exhausted quickly.

Because of this, I predict that programmatic job advertising will grow little in DACH in 2024. I will find some numbers to compare this at the end of 2024.

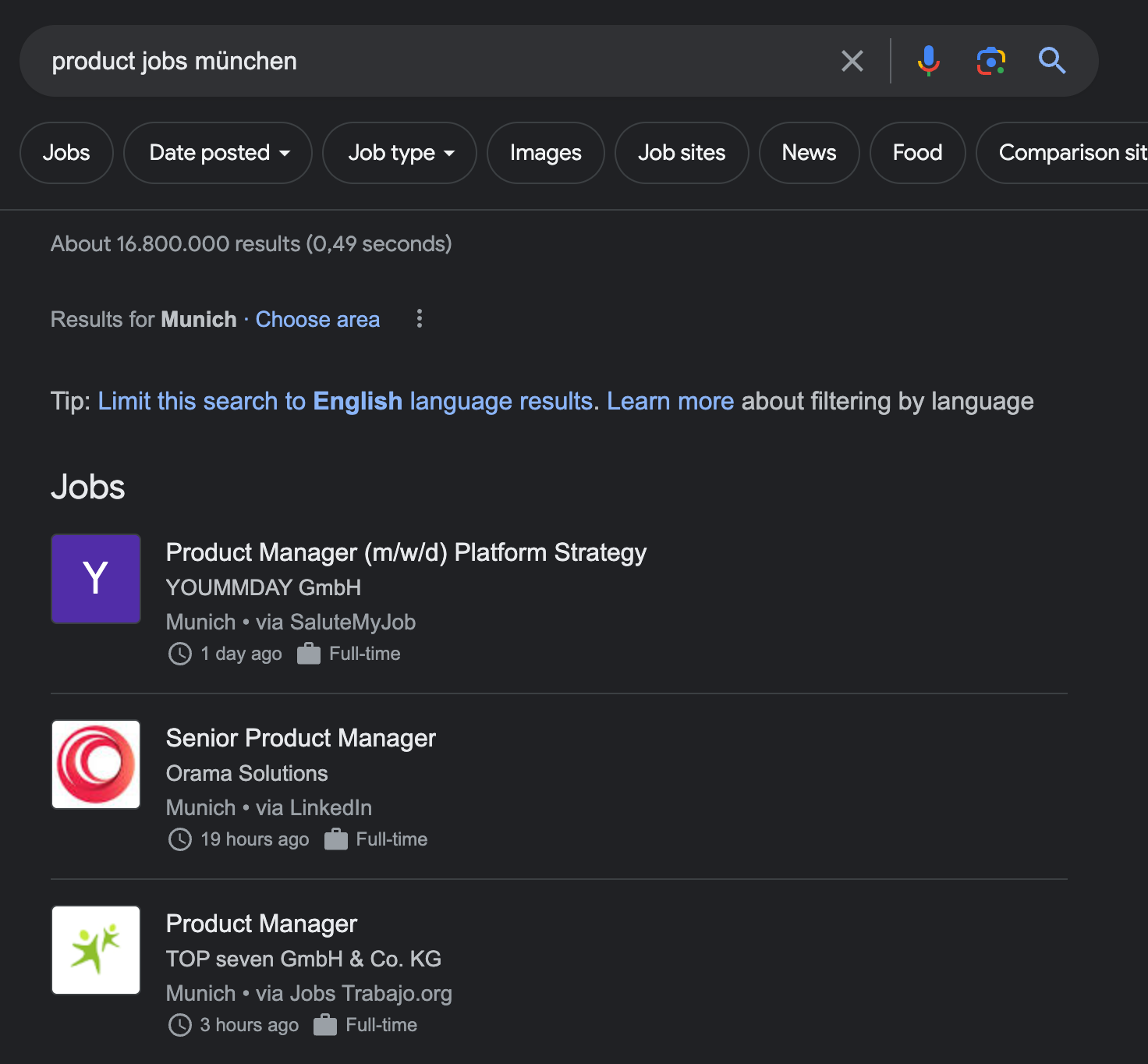

Google Job Ads will launch in Q1 in the US, Q2 in the UK, and Q4 in the EU

The product everyone in recruitment marketing has been afraid of is going live soon. We are seeing more and more alpha tests today, as well as some leaked slides. The product is coming to recruitment marketing, and it will MAKE SOME NOICE.

I can’t wait to have a product capable of delivering programmatical traffic to a single job with zero overspending or underspending, matching user search intent and delivering relevant job seekers.

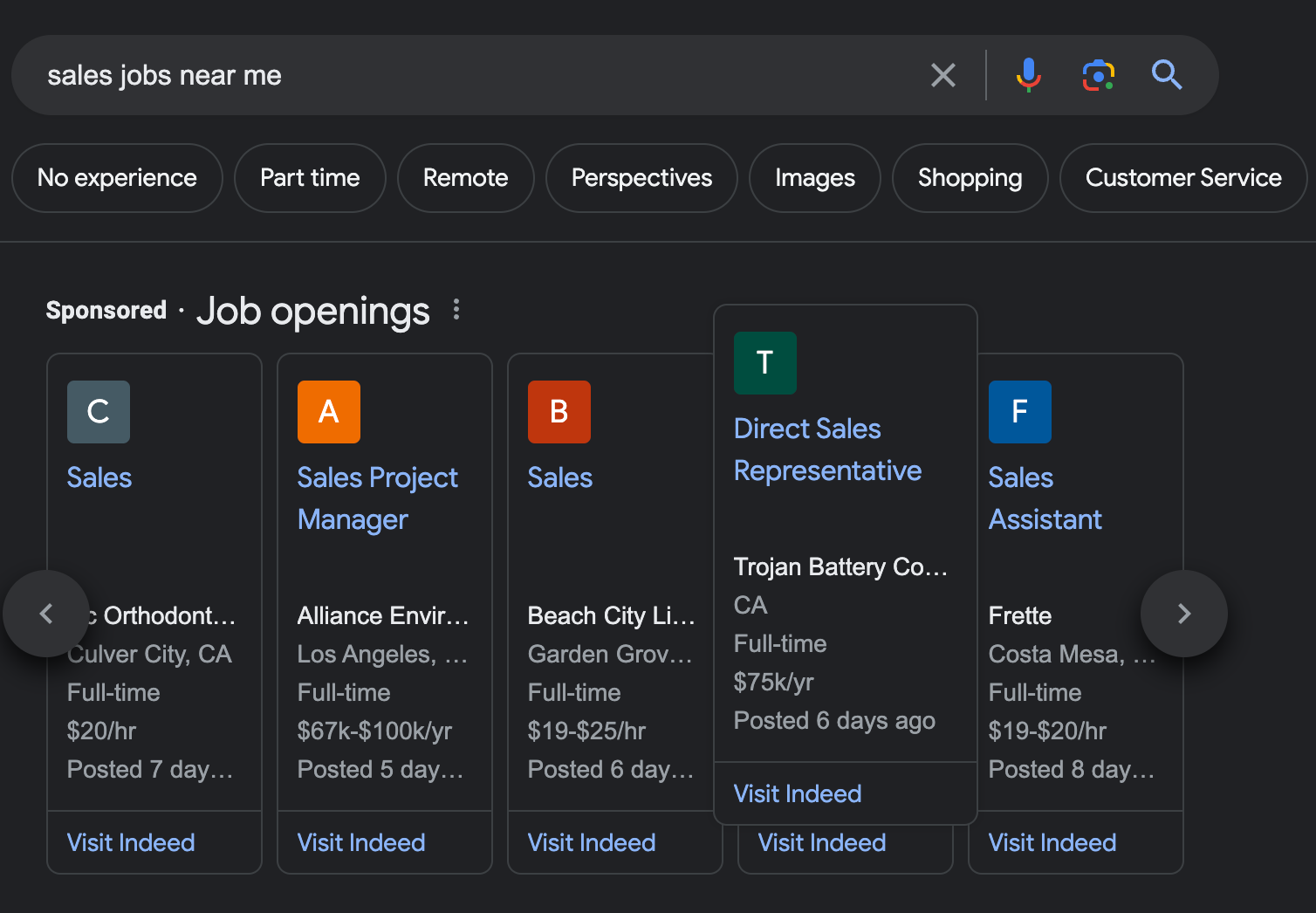

New Google Jobs UX

I wrote about this a few times on Linkedin. Google has been testing a new UX for Google Jobs.

Although it is hard to predict when and if Google will push a new product, the new UX is required to launch Google Job Ads. Therefore, if Google Jobs ads launch, we also must see an update of Google Jobs.

AI-automated applications will become a real problem in the industry and drive CPA prices down.

This is a no-brainer. If the adoption of AI-application automation tools continues in 2024, the number of irrelevant applications will increase, driving CPA prices down.

How can we track if this is true? We will wait for the final recruitment market report from Appcast and compare CPAs across the industries.

The ATS Integration market will get in trouble.

I rarely talk about the ATS market, but in 2019, I led product development at JobSync, working on integrating major ATS platforms like Workday and Taleo in leading aggregators (Indeed, CB, Monster) and Social, so I have some experience in this area.

ATS integrations have become a hot topic in 2023, and tools like Merge and Kombo have exploded, but AI-automated applications will hurt the industry. Therefore, ATS providers will likely make it harder for application suppliers to integrate with them. How so? Simple – ATS providers will require additional steps in the authentification process or will require job boards to provide sufficient examples of how AI-apply tools are detected. Good luck with that.

No one will care about X Hiring by the end of 2024

X or Twitter has been making some noise in our space, launching X Hiring. Right now, the service is very questionable – there are many jobs behind a sign-up wall and very little product vision besides a job board from the 90s. Pair this with the overwhelming feedback that finding qualified applicants on X is not easy, and you have all the ingredients for a massive fail.

Is this the latest Hyperloop, or is Elon Musk going for the “new” and “better” LinkedIn on X? I don't know. But by the end of the year, no one will remember X Hiring.

Distressed Job Aggregator Acquisition

We have had some intense chatter about three names in the job aggregator space who are not doing great financially. They mostly scaled in times of cheap capital and booming hiring markets. Now that these times are over and are not coming back anytime soon, these companies become financially impossible to run. Still, they have good assets, so I predict at least one distressed acquisition where the acquirer will fully assimilate the brand.

No Stepstone IPO

The Stepstone group missed the perfect time for an IPO; now it is too late. There are generally two revenue drivers of the Stepstone Group – the business in Germany and Appcast (mainly the US).

The economy in Germany is shaky, and the outlook is still quite unclear. Other macro factors don’t get a lot of attention. We have elections in the US in 2024, and with the economy in a questionable state, labor markets will not be exceptional next year. Stock markets are forward-looking, so doing an IPO now would result in bad pricing. All points to a further postponement.

LLM's use case for HR Tech is still unclear

Don’t get me wrong – Large Language Models are fantastic technology, and I love using them for job classification, CV Parsing, and SEO.

However, as with every tech trend, the term LLMs gets thrown at almost any issue in our industry – let’s do matching with LLMs, do career path prediction, do scraping, and the list goes on and on.

The stage of this technology is too early to find use cases that have actual business value for online recruiting beyond SEO and some use cases for prototyping. Therefore, by the end of 2024, there will be no clear use case for LLMs in recruitment marketing.

An explosion of (failing) AI-Recruiter Startups

We will see an explosion of companies promising AI-automated search, identification and scoring of candidates. I have already heard of two – Holly and Moonhub. I honestly think most will fail; here is why.

It looks like a logical thing to do. Use ChatGPT to navigate the conversation and Boolean search landscape and summarize search results. I have little doubt that the technology side will work out; the problem is that LinkedIn is still the best place to find active seekers and profiles, and they don’t like their public and non-public data being scraped. So, even if you build the best ChatGPT wrapper, you still have the problem of getting profiles.

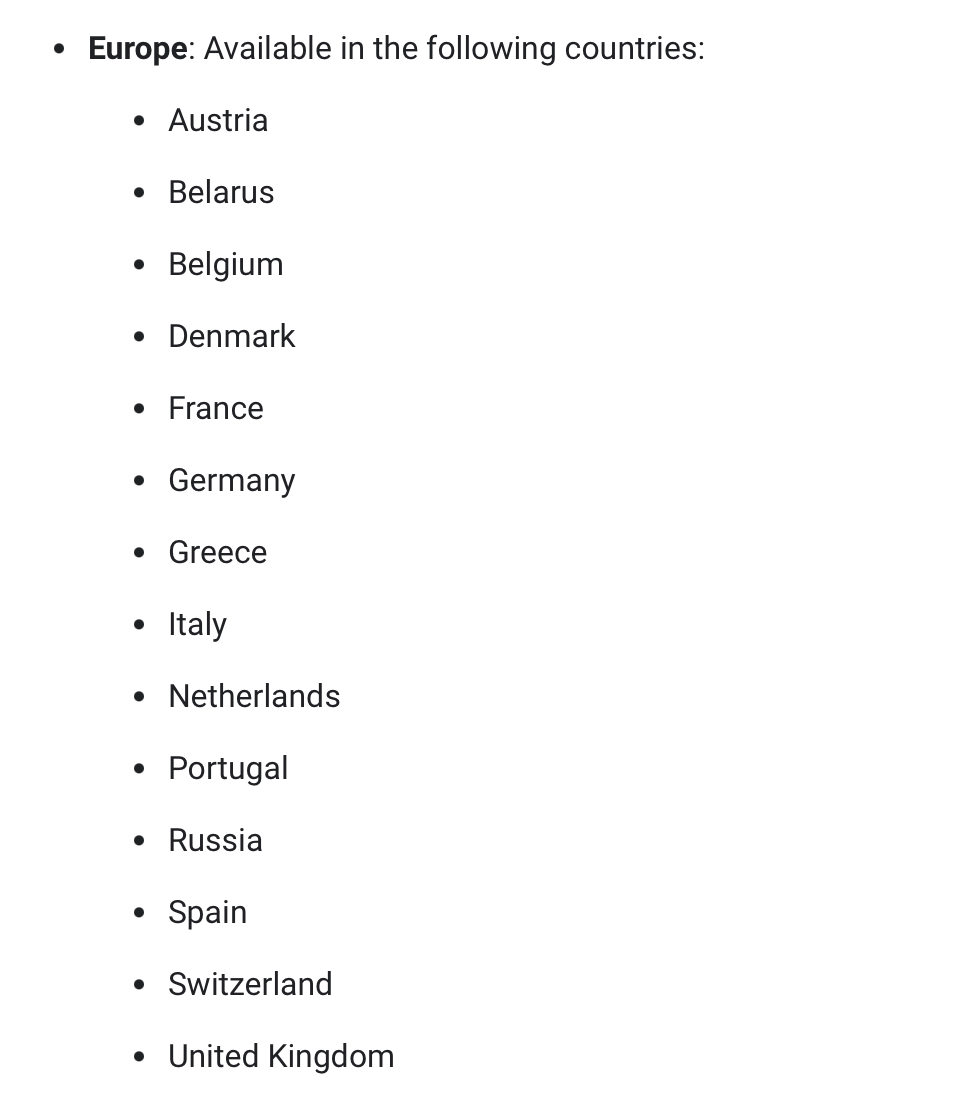

Google Jobs launch into at least one Scandinavian country besides Denmark

The last time a new Google Jobs country was launched was in 2021 in Denmark. Looking at past data, 2023 was the time to launch a new country, and the Scandinavian markets (Sweden, Norway, Finland) had the highest probability of getting a new Google Jobs feature.

Unfortunately, due to a claim from JobIndex, these plans were put on hold. Nothing will come out of this claim, so we might see a new Google Jobs launch once it ends.

You can monitor the current list of Google Jobs countries here.

That's it!

I will make a review in December 2024.

If you enjoyed reading this, subscribe to my newsletter and get my latest posts in your mailbox or follow me on Linkedin